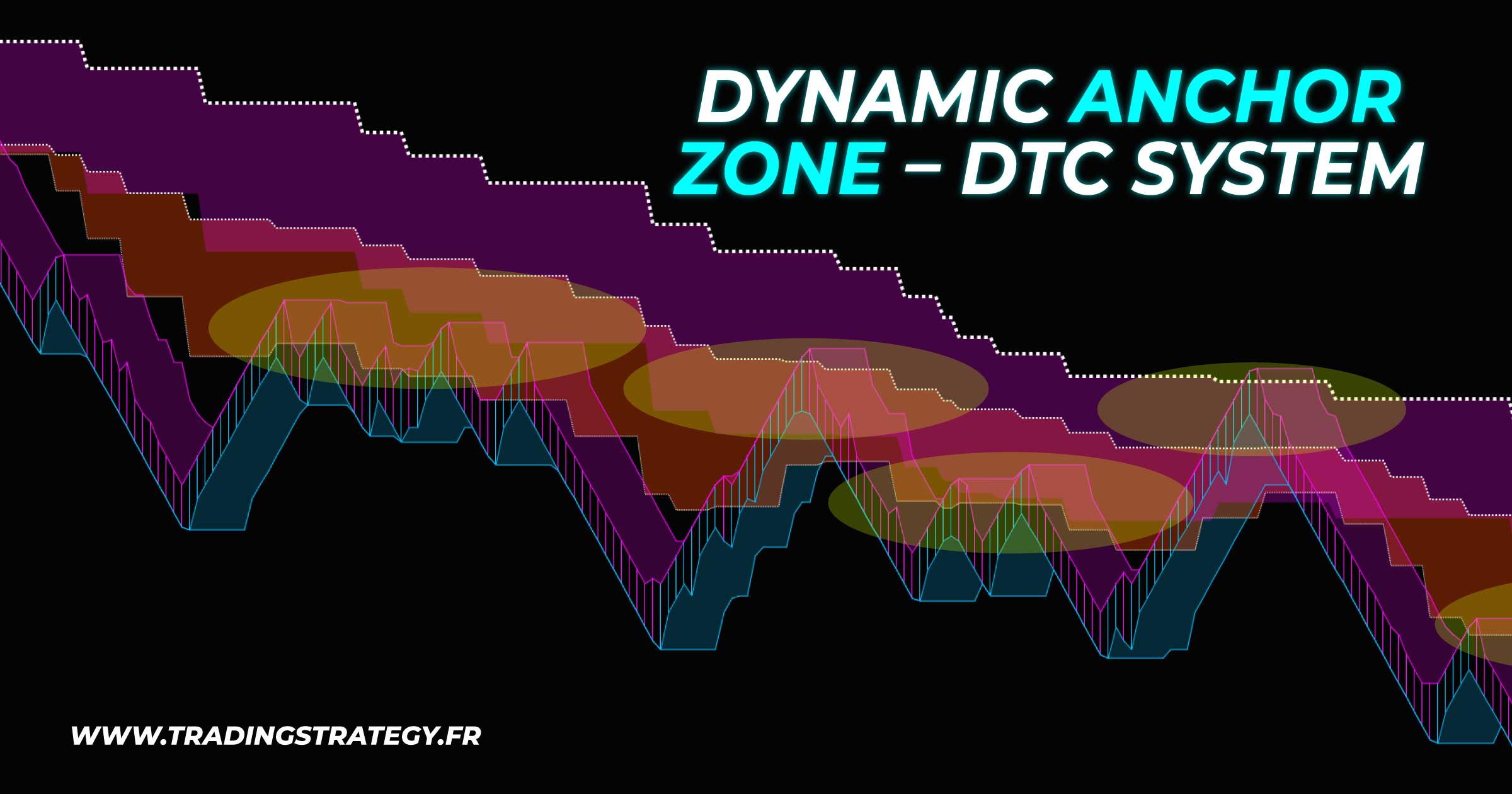

In the Dynamic Trigger Control System (DTC System), Dynamic Anchor Zones go beyond being mere areas of pause or decision. They are dynamic and strategic tools that model dominant flows, such as Up Flows and Down Flows, and capture key transitions between impulses (Rush) and corrections (Drop).

These zones provide a visual representation and a focal intervention area, helping traders interpret and leverage market movements while staying aligned with broader market conditions.

What Is a Dynamic Anchor Zone?

A Dynamic Anchor Zone is a dynamic opportunity zone that evolves with market movements to reflect dominant flows. It highlights moments where the market slows, hesitates, or signals a strong likelihood of behavioral change.

Key Characteristics:

- Flow Modeling: These zones track transitions between Up Flow and Down Flow, pinpointing impulses (Rush) and corrections (Drop) with precision.

- Dynamic Behavior: They continuously adapt based on current market interactions and conditions.

- Multi-UT Observation: Their utility is maximized when applied to broader trading units (UTs), offering a coherent view of overall market flows.

The Role of Dynamic Anchor Zones in the DTC System

Modeling Up Flows and Down Flows:

- Dynamic Anchor Zones visually represent dominant flows, showing where the market demonstrates strong impulses (Rush) or slowdowns (Drop).

- They highlight phases of transition or dominance, simplifying the reading of overall dynamics.

Key Observation Areas:

- Intervention Points: These zones act as strategic points for entering positions based on price reactions, complementing Trigger Zones.

- Critical Reactions: They identify areas where the market slows or makes significant moves, enabling precise action opportunities.

Strategic Interaction with Trigger Zones and Momentum Line:

- Trigger Zones: Dynamic Anchor Zones enhance Trigger Zones by expanding the context of dominant flows and decision areas.

- Momentum Line: They validate impulses and corrections within these zones, reinforcing entry or exit decisions.

Dynamic and Coherent Analysis:

- Their adaptability to changing conditions makes them reliable markers for observing and exploiting transitions between impulses and corrections, particularly in contexts like Synergy Flow or Dissonance Flow.

Practical Examples:

Transition Between Up Flow and Down Flow:

A Dynamic Anchor Zone may signal a slowdown in an Up Flow, followed by acceleration into a Down Flow, indicating a potential reversal.

Validation in an Up Flow:

A break within a Dynamic Anchor Zone, combined with a Rush, confirms the continuation of movement within the dominant dynamic.

Slowdown in a Down Flow:

If the price reaches a Dynamic Anchor Zone and shows a Drop, it may indicate a correction or pause in the flow.

Advantages of Dynamic Anchor Zones

- Clear Flow Representation: They dynamically model transitions between Up Flow and Down Flow, providing an intuitive and precise market reading.

- Multi-UT Analysis: Their effectiveness is amplified when used across multiple trading units, enhancing observation coherence and relevance.

- Alignment with the DTC System: Combined with Trigger Zones, movements like Rush and Drop, and the Momentum Line, they offer a comprehensive and actionable strategic view.

Conclusion: Dynamic Anchor Zones in the DTC System

Dynamic Anchor Zones are fundamental elements of the DTC System, serving to model dominant flows while offering strategic intervention points. Their role is to clarify transitions—whether pauses, reversals, or continuations within flows.

To maximize their effectiveness, combine Dynamic Anchor Zones with other system tools, such as Trigger Zones, the Momentum Line, and Synergy Flow analysis, for a deeper understanding of price dynamics.